When it comes to managing our investments, we can be our own worst enemies. Behavioral finance research has revealed how emotional and cognitive biases can lead investors to make financial decisions that harm rather than benefit them. From panic selling during market downturns to overconfidence in bull markets, ingrained behavioral patterns frequently result in inappropriate asset allocation, poor market timing, and reduced long-term returns.

This is especially relevant as we enter 2025. With the stock market and many other asset classes near all-time highs after two years of strong returns, understanding these biases is more important than ever. They are also the first step in developing a more disciplined and rational approach to investing. What are some of the most common behavioral traps and how can investors avoid them?

Recency bias results in short-term thinking

First, recency bias, or focusing too much on recent events rather than long-term patterns, can lead investors to make bad decisions. Market gains over 2024 are a perfect example of the perils of letting short-term concerns drive long-term investment decisions. Despite many concerns around a recession, the Fed, the presidential election, geopolitical conflicts, and the general fear of volatility, the S&P 500 has gained nearly 30% with dividends. This highlights how markets can climb a “wall of worry” even during challenging times.

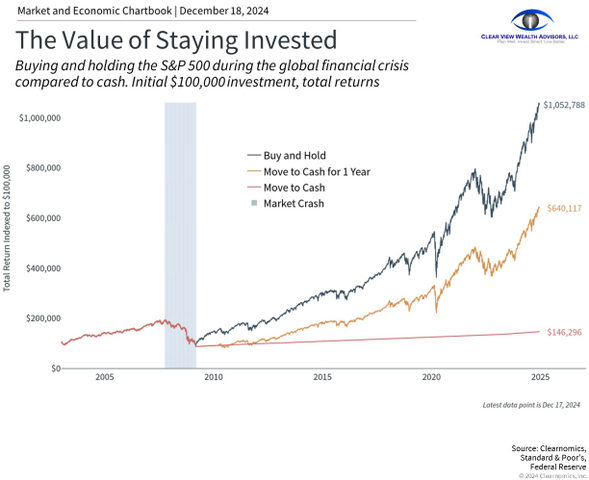

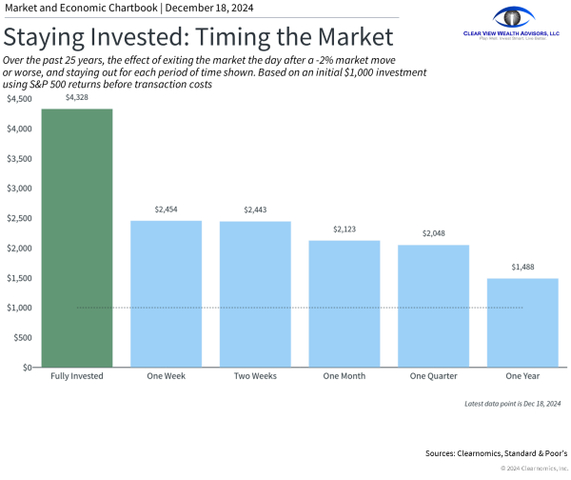

As this chart shows, investors who did not stay invested in an appropriate portfolio during the 2008 financial crisis most likely derailed their financial plans. Those who switched to cash for extended periods missed out the most, but even investors who did so for only one year at the market bottom in March 2009 ended up significantly worse off than those who stayed fully invested, despite the significant market swings.

While we’re focusing on the 2008 financial crisis in this example, the same is even more true for the 2000 dot-com crash, the 2020 pandemic bear market, the 2022 pullback, or any other period of market turmoil.

Recency bias can cause investors to put too much emphasis on recent market events while undervaluing longer-term patterns. This can mean pulling money out of the market after a crash, or over-allocating to stocks when they are doing well, at the expense of portfolio balance. While it’s normal to feel concerned during periods of uncertainty, emotional reactions to market movements tend to lead to poorly timed investment choices and missing out on long-term gains.

Rather than trying to predict short-term market moves, investors should maintain a disciplined approach aligned with their risk tolerance and time horizon - ideally with the guidance of a trusted advisor. Having a well-thought-out financial strategy can help provide perspective during both bull and bear markets.

Fear of loss can hold investors back

The next cognitive trap investors should be aware of is loss aversion. Popularized by psychologists Daniel Kahneman and Amos Tversky, loss aversion is the concept that people experience greater negative emotions following a loss than they do positive emotions from a gain of equal size. For example, finding a ten dollar bill on the sidewalk feels great, but realizing you dropped a ten dollar bill on the ground - or that you overpaid for something by ten dollars - feels comparatively worse.

Fear of losses can make investors overly cautious, causing them to keep too much in cash and potentially miss out on longterm growth opportunities. Loss aversion can also drive investors to panic sell during market declines, locking in losses at the worst possible time. This bias can lead to opportunity costs when investors refuse to invest available funds during periods of uncertainty - such as staying out of markets due to fears of potential losses.

For example, during the 2020 market downturn, many investors panicked and sold their holdings at the bottom, causing them to then miss out on the rapid recovery, highlighting how loss aversion can lead to poor timing. Historical market corrections show that patient investors who stayed in the market through temporary declines generally benefitted in the long run. To put it another way - the fact that it is challenging to stay invested is exactly why investors are rewarded.

Home bias can lead to missed opportunities

Third, home bias is the tendency to favor domestic stocks over international ones because of a feeling of familiarity or comfort. In the extreme, investors may focus only on the companies they or their friends and family work for, those in their hometowns, etc. While this may make sense because these are the companies and stocks they know well, it limits portfolio growth and diversification. Investments in other countries, which are less correlated to U.S. markets, can act as a hedge, helping to reduce risk in an investor’s portfolio.

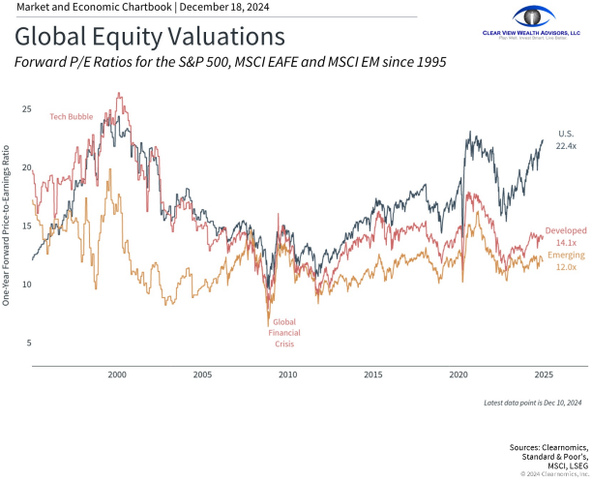

Concerns about currency fluctuations, international regulations, and perceived higher risks in foreign markets can reinforce this bias. Additionally, U.S. stocks have outperformed international markets over the past decade and have consistently delivered superior returns over that time, driven by a dynamic and innovative economy, robust corporate governance, and deep, liquid capital markets.

Despite this, international markets continue to offer unique opportunities and potential diversification benefits for global investors, along with lower valuations. Even though there are greater risks in other parts of the world, especially in emerging markets, investors are often rewarded for these risks over long periods of time. As the accompanying chart shows, international markets are far more attractive than U.S. markets when comparing valuation ratios.

The bottom line? While behavioral biases can work against investors, understanding these biases is the first step toward better decision-making. Rather than allowing emotions to drive investment decisions, having a disciplined, long-term approach is the best way to achieve long-term financial goals.

Steve's View ...

When investing, it's always best to keep things in perspective. I realize that can be hard especially when there may be uncertainty caused by macro news items. Whether it's the results of an election, direction of government policy, or news headlines about geopolitical tensions, the world can seem uncertain and scary. Naturally, you'll be worried about your retirement nest egg.

So, what should you do?

The first thing is to NOT panic. Second, let's not throw the baby out with the bath water (related to #1). Third, review and understand the assumptions used in your plan with a focus on your spending and tax assumptions. Based on this information, you can then make reasonable adjustments to your portfolio so that it will generate the funds needed to cover any funding gap for your lifestyle.

When Will the Stock Market Drop?

I hear this question a lot. I wish I knew, but my crystal ball is very cloudy and unreliable for guidance. But I do know that the economy continues to show great resilience and many positive metrics such as continued GDP growth, consumer and corporate spending, and strong unemployment. That said, there is still a risk of a downturn. As of this writing, financial markets place the odds of a recession in the US at 25% mainly because of geopolitical risks, rising government deficits, and pressures from Fed monetary policies and proposed tariff policies that could reignite inflation.I'll have more to say on this in my extended 2025 Market Outlook.

Portfolio Allocation

The Outlook:

What does this mean for investor portfolios? I think that it's fair to assume that past equity performance may not continue. Equity markets have relied on the performance of a small handful of stocks. While performance has been broadening slightly to additional names, it still is dominated by the Magnificent 7. Lofty price-earnings ratios imply future returns to average 3%. Publicly traded bonds offer tight spreads between short- and long-term maturities. Fed rate cuts may not generate the kind of gains from already issued bonds that investors may want.

Next Steps - More Diversification with Alternatives:

With the prospect that future real returns (i.e. above inflation rates) may not be robust and may even disappoint in the near term, I believe that portfolios will be better positioned and more resilient when adding more alternative assets that may not react in the typical way as stocks and bonds. This is why I continue to recommend inflation-protected US Treasury securities, high-quality short-term corporate bonds, and even commodities. To help insulate a portfolio from near-term volatility, portfolios should include alternatives like "defined outcome" or "buffer" ETFs that absorb 15%, 20% or more of any decline in stock and bond markets. Selective use of "managed futures" may also help mitigate near-term market corrections. Finally, almost all investors will benefit from the better value from private credit and private equity now available in ETFs and "interval" mutual funds.

Links to Market Commentary:

For detailed market commentary and economic insights, visit the Clear View Wealth Library found at www.ClearViewWealthAdvisors.com or www.TaxWealthNetwork.com under the "Smart Money Insights" and "Steve's Market Insights" tabs.

* https://www.taxwealthnetwork.com/blog

* https://www.taxwealthnetwork.com/steves-market-insights

Information provided in these materials has been drawn from resources deemed reliable. Clear View Wealth Advisors, LLC ("RIA firm") and Steve Stanganelli, CFP(r) ("Advisor") may provide additional commentary accompanying the materials. Any commentary by the source materials may differ from opinions expressed by the Advisor or RIA firm. Commentary and opinions of the Advisor and RIA firm are provided in good faith.

Chart books, newsletters, and related materials are distributed for general informational and educational purposes only and are not intended to constitute legal, tax, accounting or investment advice. All investments involve risk, including loss of principal, and past performance of a security, cryptocurrency, financial product, or strategy does not guarantee future results. Neither the RIA Firm nor the Advisor represent that the securities, cryptocurrencies, products, or services discussed in any of these materials or related websites are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security, cryptocurrency, or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

Any investments or strategies mentioned may not be suitable for all investors. Investors should consider the investment objectives, risks, and charges and expenses of any investment before investing. Investors are advised to consult with their financial and/or tax advisors and refer to any prospectus for any investment.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.