As we begin the final quarter of the year, financial markets and the economy have defied the expectations of many investors. Rather than falling into recession, the economy has grown steadily, albeit at a slower pace, and inflation rates have fallen toward the Fed’s target. As a result, the macroeconomic environment has shifted to a monetary easing cycle, propelling the S&P 500 and Dow Jones Industrial Average to new all-time highs and boosting bond returns. The first three quarters of the year are a reminder that it’s often best to focus on the longer-term trends rather than events in the rearview mirror.

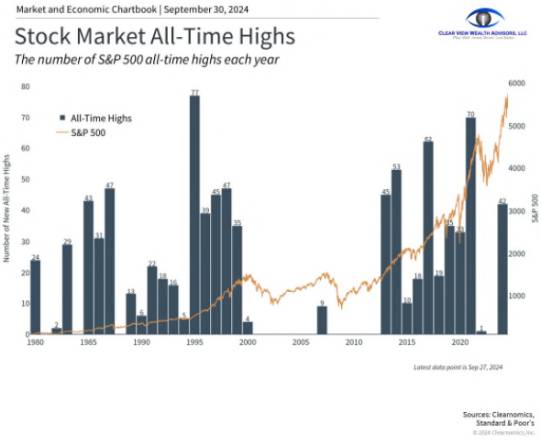

1. The market achieves many new all-time highs during bull markets

Of course, there are still many risks in the months ahead. The path of Fed policy is uncertain, and investors are already debating the size of the next rate cut. The presidential election is still close and there are wide-ranging implications for tax policy, regulation, trade, and more. Geopolitical conflicts are worsening with possible implications for global stability, supply chains, and oil prices. Market swings are always possible, especially with valuations and earnings expectations at heightened levels.

The reality, however, is that facing risks is unavoidable when it comes to investing and planning for the future. How investors choose to react to those risks is ultimately what determines investment and financial success. Rather than trying to time the market to avoid these risks, it’s far better to hold a well-constructed portfolio that can weather different market environments. Below, we provide perspective on five important factors driving the market and what they might mean for investors in the coming months.

First, the market has experienced many new all-time highs this year, including during this past quarter. While this performance is encouraging, it can also create unease among investors who may worry that we may be “due for a pullback

During bull markets, stock indices have historically reached many new all-time highs, as shown in the accompanying chart. This is almost by definition and is a result of sustained earnings, economic growth, and improving investor sentiment. New all-time highs have not been a reliable predictor of market pullbacks since it’s the underlying market and economic trends that matter. Attempting to time the market based only on index levels often proves counterproductive for this reason

Of course, market fluctuations are an unavoidable part of investing, and a decline will inevitably occur at some point. However, predicting the timing of such declines is not only challenging, but markets have historically made both higher highs and higher lows. For example, the pullbacks that occurred in April and August this year are a reminder that the market can sometimes recover faster than many investors expect. While the past is no guarantee of the future, it is often better to simply stay invested than to try to jump in and out of markets.

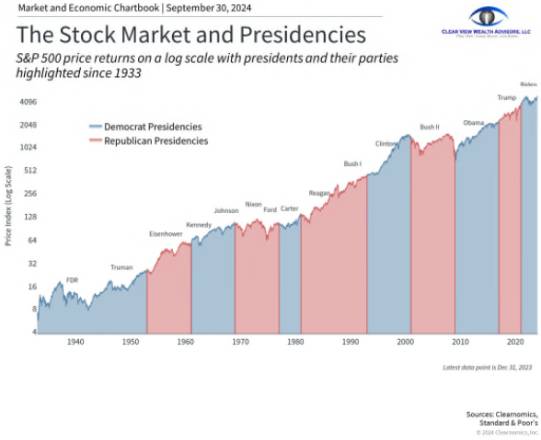

2. The market has performed well under both political parties

Second, many investors are concerned about the potential impact of the presidential election on the economy. According to polling data from the Pew Research Center, eight out of ten registered voters say the economy is very important to their vote in the presidential election. As the race intensifies, it’s crucial to remember that while elections are important for the country and as citizens, it’s important not to vote with our portfolios and savings.

History shows that the stock market has experienced long-term growth under both major political parties, as seen in the accompanying chart. It is not the case that the market or economy crashes when one political party is in office. This is because the underlying drivers of market performance – economic cycles, earnings, valuations, etc. – are far more important than who occupies the White House.

That said, policies can certainly affect taxes, trade, industrial policy, regulatory frameworks, and more. However, policy shifts often occur gradually, and their timing and impacts are frequently overestimated. What politicians promise is often different from what is ultimately enacted. Thus, investors should focus on long-term economic and market trends rather than daily poll results. Investors concerned about the impact of specific policies on their financial strategies should work with a trusted advisor.

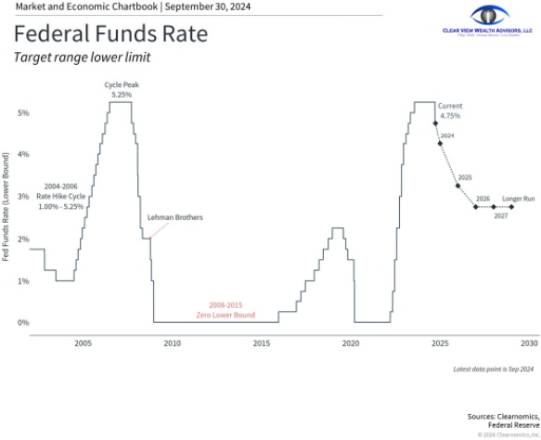

3. The Fed is expected to cut rates further

Third, inflation continues to moderate, with the most recent data showing the PCE price index, the Fed’s preferred inflation measure, increasing just 2.2% from a year earlier, approaching the Fed’s target rate of 2%. Meanwhile, the labor market shows continued signs of slowing with unemployment at 4.2%, although this is still low by historical standards

These economic conditions set the stage for the Fed’s first 50 basis point reduction in interest rates in September, with more cuts expected through the rest of the year and in 2025. The market has been anticipating cuts of various sizes all year and rallied in the days following the announcement

Historical rate cuts are difficult to analyze because

why

the Fed cuts rates is more important than when or by how much. The Fed has typically cut rates during economic and financial crises, such as in 2008 or 2020. These are times when the economy and market are expected to struggle for extended periods

In contrast, the current situation is one of achieving balance or a so-called “soft landing,” just as the Fed did in the mid-1990s. The Fed’s rapid rate hikes in 1994 were followed by cuts in 1995 once inflation fears faded. This then paved the way for a long economic expansion and bull market. While this is only one example, it is important to draw the correct historical parallels when it comes to Fed policy.

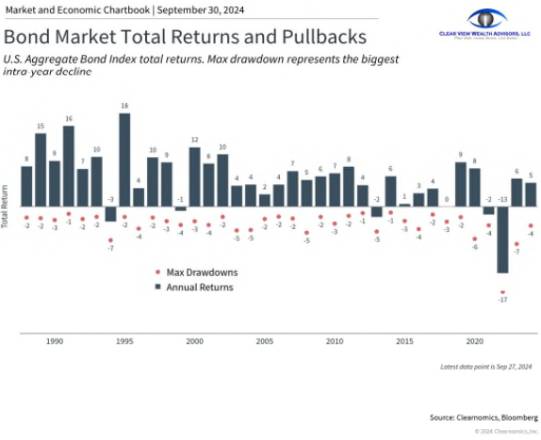

4. The fixed income landscape is shifting

Fed rate cuts have resulted in lower interest rates across maturities, as well as a “disinversion” of the yield curve. This is sometimes referred to as a “bull steepener” since it can be positive for bonds. In many ways, this is a reversal of the bear market in bonds experienced in 2022 when rates were on the way up.

Bond prices move in the opposite direction of interest rates. This is because already-issued bonds with higher rates become more valuable as market rates fall. Thus, bondholders today not only benefit from higher-than-average yields, but could experience price appreciation if rates continue to trend lower.

For the economy, lower rates improve borrowing costs for corporations and individuals, potentially boosting economic expansion and investment prospects. This can be positive for economic growth which then translates into better earnings and corporate fundamentals. Thus, despite the challenges bonds have faced in the past few years, it’s important to maintain balance across asset classes.

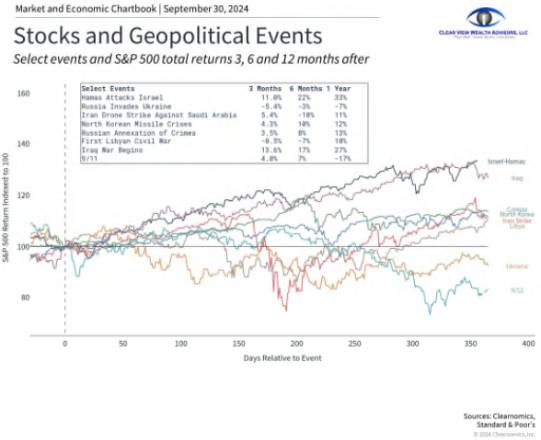

5. Geopolitical conflicts are worrisome but do not directly impact markets

Finally, tensions have risen in the Middle East as the conflict between Israel and Hezbollah has intensified. This adds to global geopolitical tensions including the ongoing war between Russia and Ukraine. While these events have major real-world impacts, their effects on the economy and stock market are less clear cut, and any impact on investors’ portfolios is typically fleeting. As the accompanying chart shows, periods with prolonged market downturns often coincided with major market events such as the dot-com crash or the 2022 rate hikes.

One channel through which regional conflicts can impact the broader economy is oil prices. The escalation in the Middle East has caused a slight rise in oil prices, but the increase is modest compared to previous crises, and the U.S.’s position as the world’s largest oil and gas producer may provide some insulation from global events

Despite geopolitical uncertainties, the stock market has experienced only two 5% or worse pullbacks this year, emphasizing the importance of staying invested and focusing on broader market trends rather than reacting to headlines

The bottom line? With the Fed cutting rates, the election on the horizon, and markets near alltime highs, it is more important than ever to stay focused on long-term financial goals rather than short-term events.

Steve's View:

- The risk of recession over the next twelve months has decreased significantly (from 60% to under 30%) especially with underlying economic activity continuing to be strong with a strong outlook for profits, and now with a more "normal" yield curve.

- The Fed's announcement indicates an increasing pace of total rate cuts through the end of next year at somewhere between six and eight (including the one we just had) with each ranging between 0.25% and 0.50%.

- Odds are that the likely target for short-term Fed rates is now 3%-ish (2.875% to 3.25%) in line with the Fed's announced "higher for longer" policy.

- With lower rates, areas of the market that are credit sensitive should improve. These include sectors that rely on credit such as real estate and technology and especially those equities in the small-cap space.

- Investors have built up lots of cash. With lowering yields on money market accounts, there will be likely movement as investors deploy cash to higher yielding opportunities such as private credit, utilities, real estate, and financials

- Closed-End Funds (CEFs) should be considered since they'll offer higher yields and have improved borrowing costs to go along with their strategies. There are a number of such funds I'm monitoring that are in the corporate and muni bond space as well as large-cap equities.

- Continued growth and economic expansion means that inflation may be coming back late in 2026; so, it's a good idea to continue to hold defensive positions through fixed-income investments such as floating rate notes and US Treasury Inflation-Protected Securities and equity investments such as real estate and commodities.

Information provided in these materials has been drawn from resources deemed reliable. Clear View Wealth Advisors, LLC ("RIA firm") and Steve Stanganelli, CFP(r) ("Advisor") may provide additional commentary on accompanying the materials. Any commentary by the source materials may differ from opinions expressed by the Advisor or RIA firm. Commentary and opinions of the Advisor and RIA firm are provided in good faith. Any investments or strategies mentioned may not be suitable for all investors. Investors should consider the investment objectives, risks, and charges and expenses of any investment before investing. Investors are advised to consult with their financial and/or tax advisors and refer to any prospectus for any investment.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.